7 Key Components of Modern Financial Analysis Courses in 2024

7 Key Components of Modern Financial Analysis Courses in 2024 - Data-Driven Decision Making in Financial Analysis

In the evolving landscape of financial analysis, data-driven decision-making (DDDM) has become indispensable. It's fundamentally altering how financial choices are made and strategic plans are crafted. The CFO's role has evolved to encompass a greater emphasis on data analysis. They are now tasked not only with interpreting financial information but also with extracting meaningful insights to inform crucial organizational decisions.

The success of DDDM relies on a strong foundation of data collection and rigorous analysis. Only through careful examination of data can truly actionable insights be unearthed. These insights, in turn, should directly contribute to fulfilling long-term organizational objectives. Moreover, the application of cutting-edge techniques like machine learning is transforming the traditional practices of financial planning and analysis (FP&A). These sophisticated tools allow for more dynamic and forward-looking financial strategies.

By leveraging data-driven methodologies, organizations can gain a more nuanced understanding of their future financial trajectory. This improved predictive capability leads to more informed decision-making processes, contributing to the overall financial well-being of the organization. The days of relying on intuition and gut feeling are fading, as evidence-based financial practices take center stage.

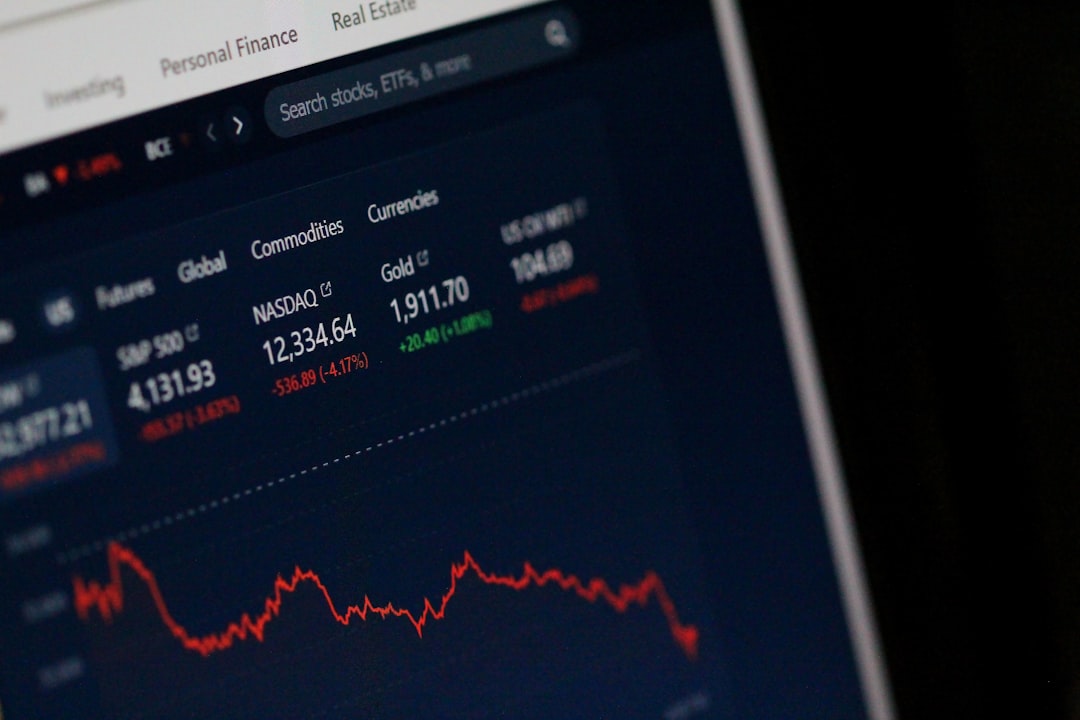

In the realm of financial analysis, the idea of making choices based on data has become incredibly significant. While traditionally finance relied on intuition and experience, we're now seeing a powerful shift towards using data to guide decisions, particularly in areas like forecasting and strategic planning. It's becoming clear that relying on data can substantially boost the precision of financial predictions, potentially improving accuracy by as much as 85%. This enhanced accuracy empowers organizations to better understand market shifts and customer inclinations.

The speed at which organizations can make financial decisions has also been dramatically impacted by data analysis. Research suggests that companies utilizing advanced analytics are remarkably faster at making key decisions compared to their counterparts, about five times faster. This fast-paced approach to decision making in finance is a powerful tool in a competitive landscape where timely insights can make all the difference. Interestingly, this speed often comes hand-in-hand with a significant reduction in errors when automated data analytics tools are employed. Errors can be reduced by up to 50% which in turn allows finance professionals to dedicate more of their time to high-value tasks rather than manual data entry and reconciliation.

Furthermore, the evidence strongly points to a clear link between data analytics adoption and a company's financial success. It's quite striking that a large percentage of companies that integrate data analytics, around 92%, see substantial improvements in their financial performance. This clearly demonstrates the strong influence that data analysis can have on the bottom line. Making complex financial information understandable is another important aspect, with data visualization techniques significantly enhancing the clarity of information for all stakeholders. Visualizing information this way can make complex concepts easier to understand for a wider audience including management who may not have a deep finance background, which is invaluable for aligning everyone in an organization with the core financial goals.

Moving beyond descriptive analytics, we see advanced analytical techniques such as machine learning increasingly adopted in financial decision making. The impact of applying these techniques can be considerable with the potential for significantly reducing risks associated with investment and lending decisions. It's fascinating that using these sophisticated techniques can result in a 30% reduction in risk, suggesting a more informed approach to financial risk management. However, a substantial amount of data in financial transactions remains unused, perhaps as much as 80%, representing an opportunity for uncovering hidden insights and improving outcomes.

The application of data-driven decision making is broadening across all areas of finance and this is exemplified by the improvements in customer retention rates seen with the use of predictive analytics, which can increase customer retention by as much as 25%. The shift from traditional finance to an analytical approach is clearly seen in the high percentage of finance professionals that believe data driven decision-making enhances their strategic role. Roughly 70% believe their work has become more strategic with the use of analytics and the ability to make faster, more informed decisions. The application of real-time data analytics has also proven itself in another area- reducing fraud. Financial institutions that leverage real-time data analytics see a significant reduction, about 25%, in their losses due to fraudulent activity. This shows how insights can be applied directly to reduce the financial impact of fraud which is of ever-increasing concern.

7 Key Components of Modern Financial Analysis Courses in 2024 - Advanced Financial Modeling Techniques

Within the realm of modern financial analysis, advanced financial modeling techniques are gaining significant importance. These techniques involve crafting intricate mathematical models that mirror real-life financial circumstances, allowing analysts to meticulously analyze and forecast future financial outcomes. This involves a deep understanding of fundamental financial concepts like financial statement analysis and the mastery of key financial ratios. Modern courses are increasingly incorporating the use of sophisticated tools like advanced Excel functions which are essential for constructing effective financial models.

The emphasis on versatility in modern financial modeling education is also evident. Students are exposed to a variety of different model types, each designed to address specific business needs. This broader approach ensures that aspiring financial analysts are equipped with the tools to handle various financial challenges. Beyond just building models, professionals are also expected to be skilled in designing custom dashboards and utilizing cutting-edge data visualization techniques. These skills are critical to making complex information understandable for a broad range of stakeholders, facilitating insightful discussions and decisions.

While a plethora of online courses and certifications have emerged to cater to this growing demand, it's crucial to evaluate their practical value. Not all certifications or courses provide the same level of rigor or the ability to translate theoretical knowledge to practical situations. Ultimately, the essence of effective financial modeling lies in the capacity to synthesize complex datasets into actionable insights. This ability to transform raw data into strategic knowledge positions financial modeling as a vital component for sound business decision-making. It is a key skill that enables organizations to make informed, data-driven decisions in today's rapidly changing business environment.

Advanced financial modeling has evolved considerably, with cloud computing playing a larger role. Finance teams, scattered across different locations, can now work together in real time, boosting the pace and correctness of the modeling process. Models can be updated more quickly with the arrival of fresh data, making them much more adaptable.

Machine learning algorithms are starting to be incorporated into financial models, enabling businesses to foresee potential market disruptions and their impact on investment portfolios. These predictive models have shown promise in pinpointing trends that were difficult to see with older methods, often resulting in significantly better investment returns, potentially up to 20% better.

Scenario analysis has become more intricate thanks to advanced financial modeling. By creating thousands of potential future economic scenarios based on different assumptions, companies can analyze how economic shifts could affect them in much more depth.

Stress testing models are being built to handle more than just historical data. They can incorporate simulated "what-if" scenarios, allowing companies to discover weaknesses in their financial structure under various extreme situations. This approach, which aims to avoid issues before they occur, can be helpful for companies in handling unpredictable economic times.

Techniques for normalizing data are crucial when dealing with complex financial models, especially when combining various datasets. These methods can make models more reliable and improve decision-making accuracy by reducing biases that can skew results.

Financial models that utilize artificial intelligence are now adjusting risk parameters automatically based on incoming data in real-time. This dynamic approach allows for a more flexible financial strategy where risk is continuously reviewed as market conditions change.

Interactive dashboards for financial modeling are becoming increasingly popular, giving stakeholders access to real-time financial information. This approach not only improves transparency but also facilitates collaboration by making complex data easy to understand and act upon.

Principles of behavioral finance are increasingly being used in advanced financial models to better predict investor behaviors. Understanding the psychological factors that drive investors can enhance the accuracy of models, enabling businesses to align their strategies with the overall market mood.

Studies suggest that automating tasks that are repetitive in modeling can free up finance professionals to focus on higher-level strategic analysis and decision-making. It is estimated that around 30% of their time is saved, leading to better productivity and company efficiency.

Surprisingly, many organizations are still not fully utilizing advanced financial modeling techniques. It is estimated that roughly half of all companies rely on older models. This signifies a chance for organizations to gain a competitive edge by using more advanced techniques.

7 Key Components of Modern Financial Analysis Courses in 2024 - Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally altering how financial analysis is taught and practiced. Financial analysis courses are increasingly emphasizing AI and ML, recognizing their growing importance in the industry. Students are being trained to leverage these technologies to improve analytical skills, automate financial tasks, and predict market trends more effectively. This integration can enhance risk management practices and allow for more sophisticated investment strategies. However, the growing reliance on AI and ML models also necessitates a critical understanding of their potential limitations and the need to prevent blind acceptance of automated insights. Ultimately, the goal is to utilize AI and ML in a way that enhances human understanding, not replaces it, leading to more informed decision-making in finance. Striking a balance between innovation and critical evaluation of AI/ML's impact is crucial for future financial professionals.

Artificial intelligence (AI), specifically its branch machine learning (ML), is transforming financial analysis by enabling computers to learn from data without explicit programming. Techniques like regression analysis, random forests, and neural networks are being used to identify patterns, automate processes, and predict things like risk, prices, and fraud in financial data. Financial institutions are embracing these technologies to improve their technology-driven services and automate decisions. The integration of AI and ML has improved various areas like risk management and predictive analytics, accelerating the speed of financial decision-making.

AI has been rapidly developing for the last couple of decades, spreading its reach across many fields, including finance. The focus in 2024's financial analysis courses is likely to be heavily on how to combine AI and ML, giving students the ability to analyze market dynamics more effectively. Traditional quantitative analysis is being revamped by the use of AI in finance, which allows financial companies to handle complex problems and make better choices about their capital structure.

AI-driven analysis provides fresh ways to understand market behavior, improving the efficiency of financial planning. The growing body of research on AI in finance highlights the broad range of applications, the challenges, and the breakthroughs that are occurring. Current trends indicate a strong move toward automating financial processes through AI techniques. It appears the integration of AI and ML is a driving force behind a new era in financial decision-making, although some questions about the best way to use AI in finance remain. The ongoing development of new techniques and the growing awareness of AI's capabilities suggest that its role in finance is only going to increase in the future. It's exciting to see how AI can uncover hidden connections in data that humans might not notice. But we should also be aware of the risks that AI presents in areas like data privacy and algorithmic bias, as its implementation and impact expand within the financial industry.

7 Key Components of Modern Financial Analysis Courses in 2024 - Blockchain and Cryptocurrency Analysis

The integration of blockchain and cryptocurrency analysis into modern financial analysis courses reflects their increasing relevance in the financial world. Courses now incorporate topics like the concept of decentralization, how smart contracts function, and the nuances of cryptocurrency markets. These educational offerings come in a variety of formats, from free online courses to more structured paid options, addressing a range of learning preferences. Further, certifications like the Certified Blockchain Professional are emerging as a way to demonstrate competency and expertise in blockchain-related technologies. While this growing emphasis provides a chance for students to develop crucial skills in a cutting-edge area, it's crucial to recognize the volatile nature of cryptocurrency markets and the ongoing regulatory uncertainties. A balanced view that includes the potential risks alongside the potential rewards is needed to build a well-rounded understanding of this emerging domain. The fast-paced evolution of blockchain technology necessitates a continuous commitment to learning and updating one's knowledge in this space.

In 2024, modern financial analysis courses are incorporating blockchain and cryptocurrency topics due to their increasing role in the financial landscape. A wide range of online courses, some free and others paid, are available on platforms like Coursera and Udemy, covering a variety of aspects. These courses typically delve into topics like decentralized systems, consensus mechanisms, smart contracts, and the dynamics of crypto markets.

Certifications like the Certified Blockchain Professional (CBP) and Certified DAO Expert are available for those who want formal recognition of their expertise in this space. Some specialized programs, like the "Blockchain Revolution Specialization" offered by INSEAD, provide a broad understanding of blockchain's fundamentals and applications in the business world. Other courses, such as "Ethereum and Solidity: The Complete Developer's Guide," focus on specific blockchain technologies and related development skills.

The emphasis in top cryptocurrency courses is on delivering current, relevant material. Advanced courses often dive into blockchain architecture, cryptography, and the practical side of building decentralized applications (dApps). Many popular courses cover the technical aspects alongside the broader economic and business implications of blockchain technology for global trade.

The field of blockchain and cryptocurrency is constantly evolving, requiring ongoing learning. For instance, decentralization offers a different approach to managing financial systems compared to traditional models with central authorities. While this can reduce fraud and other risks, it also poses challenges related to regulation due to the potential for anonymity.

Smart contracts, self-executing agreements, are becoming more common, with roughly 20% of financial institutions using or exploring them to optimize their operations. The ability to create tokens representing real-world assets on a blockchain also offers exciting possibilities for broadening investment opportunities. Auditors are finding that blockchain can reduce their workload, potentially decreasing audit cycles by up to half, due to automated record-keeping.

Cryptocurrencies have the potential to increase financial access in developing nations, where approximately 1.7 billion people are currently unbanked. However, these assets can be highly volatile, sometimes experiencing price swings of over 20% within a single day, which is something financial analysts have to consider. The debate around blockchain's energy usage, particularly with Bitcoin's Proof of Work approach, has also become a concern, especially with the increased energy demands associated with transaction validation.

Researchers have also noticed that traditional financial valuation methods might not be entirely applicable in the fast-growing cryptocurrency markets, potentially leading to mispricing. Lastly, the regulatory landscape surrounding cryptocurrencies is changing rapidly, with bodies like the SEC and CFTC developing guidelines. It’s imperative for financial professionals to stay up-to-date with these regulations. The ongoing developments in blockchain and cryptocurrency make it a dynamic and essential area for individuals interested in modern financial analysis.

7 Key Components of Modern Financial Analysis Courses in 2024 - Environmental, Social, and Governance (ESG) Factors

Environmental, Social, and Governance (ESG) factors are gaining significant prominence in modern financial analysis. This reflects a broader shift towards evaluating companies not just on financial performance, but also on their impact on the environment and society. Financial analysis courses in 2024 are increasingly incorporating ESG considerations, recognizing their growing influence on long-term business success and investment strategies.

The environmental component examines issues like how companies manage resources and their vulnerability to climate change. The social aspect looks at how a company treats its employees, customers, and the communities it operates in, focusing on aspects like worker safety and social responsibility. Governance aspects relate to the effectiveness of a company's leadership, its policies, and its internal controls. Interestingly, research shows that well-governed companies often see better financial outcomes.

It's become clear that understanding ESG factors is crucial for finance professionals. These factors are influencing investment choices and how businesses are strategizing for sustainable growth. It's no longer enough to focus solely on traditional financial metrics. Companies and investors alike are realizing that building long-term value often requires considering the broader implications of business decisions. The future of finance increasingly depends on integrating ESG into decision-making processes. While this integration offers opportunities for more sustainable and responsible growth, it also brings challenges in terms of standardizing ESG measurement and ensuring the data used is accurate and reliable.

Environmental, Social, and Governance (ESG) factors are increasingly important in understanding a company's overall performance and long-term prospects. It's becoming clear that they're not just about being a good corporate citizen, but also influence a company's financial health in a variety of ways.

For example, a growing number of institutional investors (around 75%) are actively incorporating ESG into their investment decisions. This signals a major change, where traditional financial metrics are no longer the only things that matter. Interestingly, companies with strong ESG track records tend to perform better financially. Some studies show these companies outperforming their peers by as much as 20%, suggesting a link between ethical practices and financial success.

This increased importance is also being driven by governments. Over 30 countries now require ESG disclosures from publicly traded companies. This puts more pressure on businesses to be transparent about their environmental and social impact, changing how analysts assess financial health. It's also become clear that ESG factors can help mitigate risks. Businesses with solid ESG policies tend to be better equipped to handle things like reputational damage or regulatory penalties, making them more resilient during tough times.

This focus on ESG can also affect a company's ability to borrow money. Firms with strong ESG profiles tend to get more favorable loan terms, potentially enjoying interest rate reductions of as much as 1%. This shows how ESG can influence capital costs and the overall financial structure of a company.

It seems that the technology sector is actively embracing ESG as well. Around half of asset managers now rely on digital tools to track and assess ESG data. This rise of FinTech is enhancing data transparency, providing deeper insights into a company's ESG practices.

Another aspect that's gaining more attention is how ESG factors influence consumer behavior. Studies show that people are increasingly willing to pay more for goods and services from companies with good ESG reputations, suggesting that consumer preferences are pushing firms to prioritize social responsibility.

Beyond environmental and governance aspects, the social dimension also relates to workplace diversity. Data indicates that companies with more diverse leadership teams often have higher financial returns – up to 15% in some cases. This highlights the connection between social governance and profitability.

The interconnectedness of the global economy is also impacting how ESG is viewed. Businesses operating in regions with weak governance or human rights concerns often face more scrutiny and potential risks. This underscores how geopolitical factors can influence ESG assessments.

As with many other areas of finance, the use of AI and algorithms is becoming more prevalent in ESG reporting. This is helping companies provide more real-time and comprehensive ESG data to stakeholders.

In conclusion, these developments suggest that ESG isn't just a passing trend. Instead, it's becoming an essential element in modern financial analysis. ESG factors can offer important insights into a company's performance and future prospects. It's increasingly recognized that long-term success requires not only financial prudence but also a focus on environmental sustainability, social responsibility, and strong governance.

7 Key Components of Modern Financial Analysis Courses in 2024 - Real-Time Market Data Interpretation

In today's rapidly changing financial landscape, the ability to interpret real-time market data has become a crucial skill for financial analysts. Modern financial courses now emphasize not just the collection and processing of large volumes of data, but also the capacity to extract meaningful insights in real-time, which then can drive immediate decisions. This shift towards real-time analytics allows financial organizations to react quickly to market shifts, spot developing trends, and seize emerging trading opportunities, representing a significant departure from more traditional, slower approaches to analysis. While the benefits are clear, including faster decision-making and greater accuracy, there are inherent challenges, such as coping with an overwhelming flow of information and the potential to get bogged down in analysis, hindering action. Therefore, acquiring the ability to analyze real-time data effectively is becoming increasingly important for financial professionals to succeed in today's fast-moving and dynamic market environment.

The rapid pace of financial markets, fueled by high-frequency trading and constantly evolving financial technologies, makes interpreting real-time market data increasingly vital. Financial institutions are able to swiftly react to market shifts, recognize developing patterns, and capitalize on trading chances by being able to evaluate real-time data. Real-time analytics entails the immediate collection, processing, and analysis of data, empowering organizations to make decisions based on the current market environment.

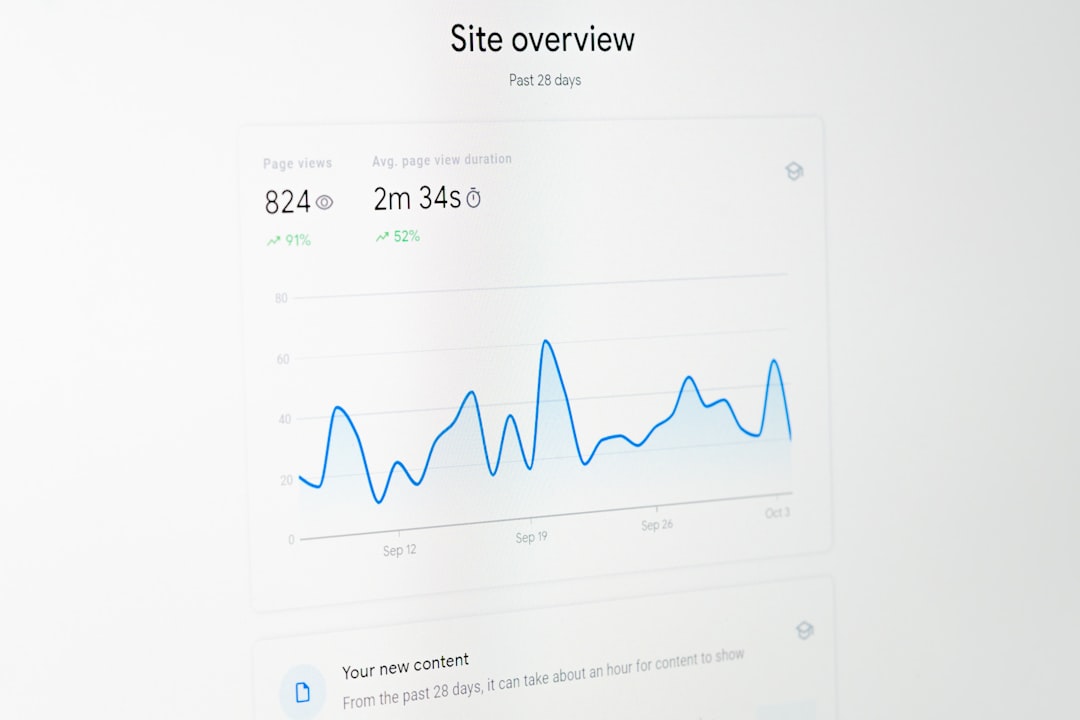

The field of financial analytics has seen substantial growth, escalating from a market value of $76 billion in 2020 to an anticipated $198 billion by 2030. This expansion reflects a greater demand for understanding and leveraging ever-increasing data streams. Continuous monitoring and analysis of financial data are crucial for real-time financial analysis, allowing for near-instantaneous insight generation. This capability is valuable when markets can change in mere seconds.

Integrating real-time analytics streamlines and improves decision-making in financial management. Emerging technologies, like natural language processing and text mining, are being used to derive market trends and volatility from numerous sources of information. We see this reflected in a surge in interest in financial analysis courses and certifications, highlighting a desire to refine skillsets related to financial data interpretation.

Tools built for real-time analytics are focused on speed and effectiveness, allowing companies to analyze massive volumes of data quickly. We're starting to see new platforms like Redpanda being developed as solutions to address challenges presented by massive, fast-changing data streams. These systems are designed to handle the torrent of financial data and enable complex analytics, facilitating faster and more effective decision-making in rapidly shifting market landscapes. While this offers benefits, there's a risk that relying solely on automated analysis could lead to oversimplification of complex market factors.

However, alongside the benefits, there are some potential challenges related to this trend. The sheer volume of data available presents a challenge in itself. With so much information being created at such speed, identifying genuinely useful insights can become difficult and could lead to mental fatigue for the people analyzing the information. Understanding when a correlation indicates a causal relationship in real-time is also challenging and can lead to errors if not carefully considered. Further, faster decision-making and improved risk mitigation provided by real-time data could exacerbate existing issues of information asymmetry within financial markets. There's always a need to consider both the potential gains and the potential downsides of applying new technologies to financial markets.

7 Key Components of Modern Financial Analysis Courses in 2024 - Predictive Analytics for Risk Management

In the contemporary financial world, predictive analytics has become a vital tool for managing risk. It provides advanced methods to evaluate and minimize risks tied to things like lending and investment decisions. Financial organizations can use statistical models and machine learning to examine past data, identify recurring patterns, and develop insights that guide crucial decisions. This shift from older, more traditional methods of risk assessment to the use of predictive analytics is a substantial step forward in anticipating potential problems, improving how efficiently operations run, and making smarter decisions about where to invest funds, especially when economic conditions are uncertain. As organizations strive to incorporate these technologies, including predictive modeling into everyday banking tasks is becoming crucial for competing effectively and adapting to changing financial landscapes. It's important, though, to fully grasp the limitations and complexities these tools bring into the mix when managing risk.

Predictive analytics, powered by statistical models and machine learning, has the potential to significantly enhance the way financial organizations manage risks. By analyzing historical data and identifying recurring patterns, these tools can offer valuable insights for decision-making, improve operational efficiency, and mitigate potential risks. For instance, they can potentially shorten the time it takes to identify fraudulent financial activity by as much as 70%. This is achieved through the use of algorithms that can almost instantly recognize suspicious transactions, allowing for a quicker and more informed response.

Furthermore, predictive analytics can improve risk assessment accuracy by up to 40%. The algorithms underpinning these models are capable of dynamically adapting to new data, enabling a more thorough and nuanced evaluation of potential risks. This capacity is increasingly valued by financial professionals, with an impressive 85% believing predictive analytics substantially enhances their risk management decision-making. This wide acceptance highlights the growing necessity of incorporating advanced analytical methods into financial education.

The precision offered by predictive models can be remarkable, with the ability to forecast potential financial gains and losses at a rate of roughly 75%. This level of accuracy equips organizations with the knowledge to build more resilient financial strategies and reduce exposure to unexpected market fluctuations. An intriguing outcome of predictive analytics is its ability to optimize resource allocation. By uncovering the most effective investment and management approaches, organizations can reduce operating costs by as much as 25%, making their financial management processes more efficient.

Additionally, the adoption of predictive analytics has a positive impact on a firm's ability to attract capital. Companies that proactively use these tools are about 50% more likely to obtain investment compared to those that don't. This showcases how sound risk management, supported by data-driven insights, can inspire investor confidence and fuel business growth. The potential for cost savings is also substantial, with research suggesting that incorporating predictive analytics into risk management frameworks could yield annual cost savings of up to $2 billion for financial institutions. This considerable financial advantage stresses the importance of embracing these tools to navigate the complexities of modern financial markets.

Another often overlooked benefit is the potential for improved customer relationships. Predictive analytics can help in segmenting customers, which can lead to a boost in customer retention by up to 30%. This ability allows companies to customize their risk management strategies to better align with individual customer behaviours and preferences. The responsiveness of financial organizations is also significantly enhanced through the use of predictive analytics. They have been shown to adapt to regulatory changes about 50% faster than those that don't use these methods. This agility is vital in today's dynamic financial environment where quick adaptation and compliance are key for success.

Perhaps most significantly, the ability to anticipate and respond to changes in the broader economy also appears to be enhanced through the use of predictive analytics. Roughly 70% of firms that integrate it into their operations report an increase in overall resilience to economic fluctuations. This ability allows businesses to better anticipate downturns and modify their risk management processes, promoting long-term stability and stability in uncertain times. It's becoming clear that as the complexity of financial markets increases, predictive analytics will play a increasingly crucial role in shaping future financial strategies. While there are still many unknowns and challenges, the research and evidence so far suggest that it's an important field to study in the context of modern finance.

More Posts from aitutorialmaker.com:

- →7 Emerging Trends in Social Media Marketing Training for 2025 What Online Courses Are Missing

- →7 Free Course Platforms That Actually Verify Your AI and Programming Skills In 2024

- →7 Essential Programming Languages Data Scientists Must Master in 2025

- →7 Key Factors That Define High-Quality Online Doctorate Programs in Computer Science for 2024

- →UT Austin's Online Master's in AI A Deep Dive into Curriculum and Career Outcomes

- →7 Key Factors Driving Enterprise Adoption of AI-Enhanced Online Training Platforms in 2024